Medical Care Cost Deductions

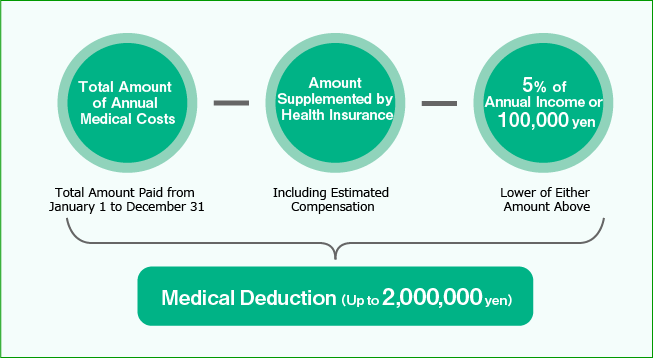

Insured persons and their dependents (family members) can deduct medical care costs from their income on tax returns if the total medical care expenses paid for the year (January 1 to December 31) exceed a certain amount. This type of deduction is called a medical care cost deduction.

Calculation Method

Calculation of Medical Care Cost Deductions

Examples of medical care cost deductions

→ 4,000,000 yen × 5% = 200,000 yen > 100,000 yen

500,000 yen - 350,000 yen - 100,000 yen = 50,000 yen (Amount of deduction for medical care costs)

*However, this deduction is not a reimbursement.

Filing Procedures

| Application Period | One month from February 16 to March 15 each year |

|---|---|

| Required documents |

Tax return, statement of medical care cost deductions, tax withholdings slip, personal seal, individual number card (or documentation to verify individual number and identity), bankbook for bank account for reimbursement transfers, etc. *The section for details on the medical care cost deductions does not need to be filled out if a medical expense notice (notification of medical care costs) issued by the Western Digital Technologies Health Insurance Association is attached. *Medical care, medicine and other expense receipts related to tax returns must be stored at your home for five years. |

*For more information, please refer to the details when paying medical care costs (medical care deductions) on the National Tax Agency website.

Self-medication Tax System (Special Medical Care Cost Deduction)

Individuals who are working to maintain and better their health as well as prevent illnesses can use the Self-medication Tax System (Special Medical Care Cost Deduction) as of January 1, 2017 to receive deductions on income for purchasing Rx-to-OTC Switch medications (medications requiring guidance and prescription drugs which have switched to over-the-counter medications).

Requirements to Use the Self-medication Tax System (As of March 2020)

During the year under review for the tax return:

- Claims cannot be made for medical care cost deductions included in the preceding paragraph

- Purchases of Rx-to-OTC Switch medications must be at least 12,000 yen in total per household

-

One of the following actions was taken as an initiative to maintain and promote better health as well as prevent illness

- Influenza vaccinations or pneumococcal vaccinations if elderly

- Health screenings (physical examination, etc.) provided by the Western Digital Technologies Health Insurance Association

- A regular physical checkup provided by employers

- Specific health checkup or specific health guidance

- Cancer screenings or health examinations conducted by the municipality as a health promotion service