Family Dependents

Health insurance not only provides benefits to insured persons but also their family dependents. These family members are referred to only as dependents, and their scope is defined by law.

The Western Digital Technologies Health Insurance Association needs to certify family members as dependents.

Adding a Family Dependent

Family members whose livelihood is supported by the income of the insured person can receive health insurance benefits as dependents. The mere fact of being a family member does not qualify someone to be a dependent for health insurance purposes. There are certain legal and other requirements that must be fulfilled.

Dependents for health insurance purposes adhere to completely different criteria from dependents under tax law or in relation to corporate allowances for dependents.

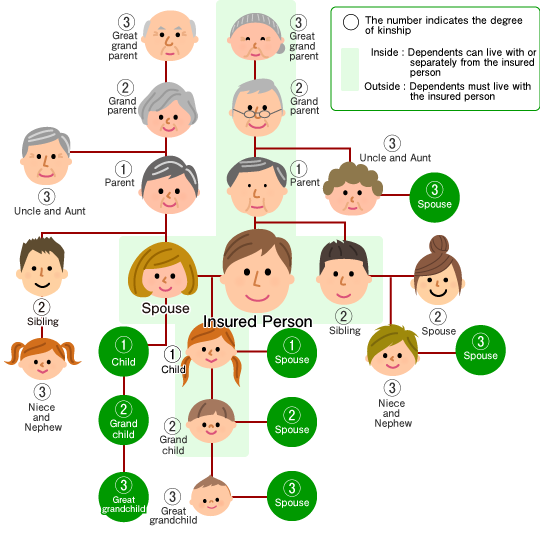

Scope of Individuals Qualifying as Dependents

|

Individuals qualifying as dependents regardless of whether living with the insured person |

|

|---|---|

|

Individuals who must live with the insured person |

|

Standards for Certification of Dependents

Each of the following requirements must be met for a person to be certified as the dependent of an insured person. The Western Digital Technologies Health Insurance Association fully reviews the following items to carefully decide whether the person qualifies as a dependent.

Individuals must live in Japan*New requirement added as of April 1, 2020

Partial revisions to the Health Insurance Act and other laws added a provision that a dependent shall, in principle, live in Japan for certification as a dependent on April 1, 2020.

As an exception to this requirement, individuals such as foreign exchange students or family accompanying an insured person overseas who have been living in Japan before departure and who have a high likelihood of returning to live in Japan in the future due to the purpose for stay overseas satisfy the requirement for a dependent to live in Japan even without an address in Japan (certificate of residence).

-

A dependent shall, in principle, live in Japan (certificate of residence)

*However, foreign nationals residing in Japan for a long stay (up to one year) on a medical-stay visa or for the purpose of tourism or recreation do not qualify as a dependent even if living in Japan (certificate of residence) according to an exemption in the Health Insurance Act.

-

An individual who does not have an address in Japan (certificate of residence) but whose basis of livelihood is in Japan

*Individuals are approved as an exception to the requirement for a dependent to live in Japan by confirming their visa status and other circumstances.

| Reason | Supporting Document |

|---|---|

1. Students studying overseas |

Copy of the visa and student ID as well as enrollment and admission certificates |

2. Person accompanying an insured person stationed overseas |

Copy of the visa and letter of appointment for overseas assignment as well as a copy of a residence certificate issued by an overseas public institution |

3. Person temporarily traveling overseas for any purpose other than employment (tourism, recreation, volunteer activities, etc.) |

Copy of the visa, proof of the volunteer dispatching agency, and the volunteer participation agreement |

4. Person who has a personal relationship, such as birth or marriage, with the insured person while assigned overseas |

Copy of documents certifying birth, marriage, etc. |

Income Requirements

- The annual income of the individual must be less than 1.3 million yen (1.8 million yen for individuals aged 60 or older or persons with disabilities)

- The annual income of the individual must be less than half that of the insured person

The tax reform for fiscal year 2025 revised the requirements for the dependent deduction for this age group and created a special deduction for specific relatives.

Effective October 1, 2025, the certification criteria for dependants aged 19 to 23 (excluding the spouse of the insured person) under health insurance will be changed.

-

The annual income requirements: Annual income of less than 1.5 million yen

*This applies to those whose dependent certification date is October 1, 2025 or later.*As in the past, a certified person's income will be estimated for the coming year, taking into account past, current or future income.

-

Age requirement: 19 years old or older, but under 23 years old

*The age is determined based on the age as of December 31st of the year in which the dependent certification date falls.*There is no requirement that the dependents be students.

- The annual income requirement for year N-1 (the year of turning 18) is less than 1.3 million yen.

- For the period from year N to year N+3 (from the year in which the individual turns 19 to the year in which they turn 22), the annual income requirement is less than 1.5 million yen.

- The annual income requirement from year N+4 (the year of turning 23) until the individual turns age 60 is less than 1.3 million yen.

- Employer's Certificate FormPDF

1.5 million yen for individuals aged 19 to 23 on December 31 of that year (excluding the spouse of the insured person)

- For the same individual, even if their annual income temporarily exceeds the income limit, they may remain eligible as a dependent for up to two consecutive years under normal circumstances.

- If the income exceeds the income limit for three consecutive years, procedures to remove their dependent status will be required.

- As a general rule, freelancers and self-employed individuals are not eligible for this program.

- The annual income of the individual is less than the financial support of the insured person

- The total income and financial support of the dependent is above the amount needed to maintain a standard quality of life

Other

- The insured person provides the individual financial support

The insured persons must be providing the majority of living expenses to the individual. Even if the income criteria are met, the individual will not qualify as a dependent if economically independent. - The insured person must have the ability to financially support the individual

The insured person must have the ability to provide consistent economic support to the family member. Even if all of the other requirements are met, the individual will not qualify as a dependent if the Western Digital Technologies Health Insurance Association determines the insured person does not have the means to provide financial support.

- A person with a higher priority obligation to support the individual, such as the mother or father in the case of siblings and grandparents, does not have the ability to do so.

- There are unavoidable reasons that the insured person must support the family member.

- Compare the couple's incomes and make the one with the greater amount of expected income for the next year the dependent.

- If the incomes are at the same level, the child becomes the dependent of the parent who is the main person supporting the household indicated in the notification.

However, for individuals aged 19 to 23 on December 31 of that year (excluding the spouse of the insured person), the daily basic allowance will be less than 4,167 yen.

If the family wishes to request the issuance of Eligibility Confirmation Document, please be sure to submit Application for (Re)issuance of Eligibility Confirmation Document along with the application.

documents

- Dependent Change Notification (Addition)

PDF Entry Sample - Application for (Re)issuance of Eligibility Confirmation Document

PDF Entry Sample - Necessary documents to include in the list of documents required for dependent certification.

Confirmation of Dependent Qualifications (Verification)

The Western Digital Technologies Health Insurance Association conducts confirmation of dependent qualifications with a set deadline and reviews continued certification as a dependent. Individuals who are unable to submit the required documentation at the time of this review may lose their eligibility as a dependent. Therefore, insured persons need to prepare and be ready to submit proof of remittance and other documents at any time.

Punitive Measures for Fraudulent Applications

If the Western Digital Technologies Health Insurance Association discovers an insured person has obtained certification of a family member who is not actually receiving financial support through a fraudulent application, the family member will not only lose eligibility as a dependent but also be required to reimburse the Western Digital Technologies Health Insurance Association for any and all medical expenses and other payments made during the relevant period.

Removing a Family Member as a Dependent

Procedures to take a family member off the dependents list must be taken if the family member who was certified as a dependent no longer fulfills the requirements for certification as a dependent due to employment, living separately from the insured person, death or other such reasons.

-

The annual income of a dependent reaches consistently 1.3 million* yen or more.

*1.8 million yen for individuals aged 60 or older or persons with disabilities

1.5 million yen for individuals aged 19 to 23 on December 31 of that year (excluding the spouse of the insured person)- The income from non-regular or part-time work increased for a wife or child who is a dependent

- The annual pension increased for a parent who is a dependent, etc.

*Please note that individuals lose qualification as a dependent as of the time they begin working (earning an income), not when their earnings exceed the maximum annual income. This policy also applies if the individual has started working but is unable to enroll in a health insurance plan at the new employer. Please make sure to complete the procedures to remove the individual as a dependent. -

A dependent begins receiving employment insurance (unemployment or other benefits)(Individuals who have extended the payment period, etc.) Please make sure to complete the procedures to remove the individual as a dependent if benefit payments will be made at a later date.

-

A dependent no longer has a relationship with the insured person

- A child who was a dependent has enrolled in another health insurance plan as an insured person

- A daughter who was a dependent marries and becomes a dependent of her husband

- A spouse who was a dependent is no longer supported by the insured person due to divorce

- A family member who was a dependent has passed away, etc.

*An individual who has been removed as a dependent needs to either enroll in National Health Insurance or another health insurance program as an insured person or complete procedures to become a new dependent of the family member who is providing financial support.

documents

- Dependent Change Notification (Removal)

PDF Entry Sample - Health Insurance Eligibility Certificate (If the relevant dependent has it.)

Date of Dependent Removal

The date for removing a dependent is the day on which the reason for submitting the Dependent Change Notification arose.

However, in the case of death, the day after the individual passed away is the day on which the dependent is removed. The date of removal as a dependent will be the date on which he/she got a job and joined his/her employer's health insurance as an insured person.

Ramifications of Forgetting to Remove a Dependent

*Please notify the healthcare provider on your next visit if an individual has been formally removed as a dependent and enrolled in a different health insurance plan.